Weekly Real Estate Monitor for April 29 - May 3

While the Federal Reserve is exercising caution regarding inflation and delaying rate adjustments, it's likely that 6 to 8 rounds of rate cuts by the end of 2025 could bring interest rates down to levels reminiscent of those pre-COVID. However, significant declines in mortgage rates shouldn't be anticipated due to the substantial federal budget deficit and heavy government borrowing will reduce the funds available for mortgage lending.

Despite home sales hovering near 30-year lows last year and maintaining a similar pace in the first quarter of this year, the current population includes 40 million more jobs and 70 million more residents compared to previous years. This implies a substantial pent-up demand from buyers for housing entering the market in the years ahead.

High Rates Don't Seem to Have an Impact on Lowering Home Prices

Home price increases saw a continued acceleration since February, even as interest rates climbed. Both the S&P CoreLogic Case-Shiller Indices and the Housing Market Index (HMI) by the Federal Housing Finance Agency (FHFA) revealed annual price growth in the 7% range. The Case-Shiller U.S. National Home Price Index, encompassing all nine U.S. census divisions, reported a non-seasonally adjusted 6.4% annual gain in February, up from a 6.0% rise in the previous month.

The FHFA HMI mirrored this movement, rising 1.2% in February, following a 1.0% increase in January, with an annual gain of 7.0%. Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics, noted, “U.S. house prices rebounded with an increase in February," observing double-digit growth in some areas. The Case-Shiller Indices track matched price pairs for thousands of individual houses, with each index, benchmarked in January 2000 at 100. The current values stand at 312.18 for the National Index and 336.00 and 319.95 for the 10- and 20-City Composites, respectively. FHFA’s HPI, based on home sales financed by Fannie Mae or Freddie Mac, was benchmarked at 100 in January 1991 and currently stands at 423.0

Adjustable Rate Mortgage (ARM) Loans Increasing as Buyers Seek Affordability

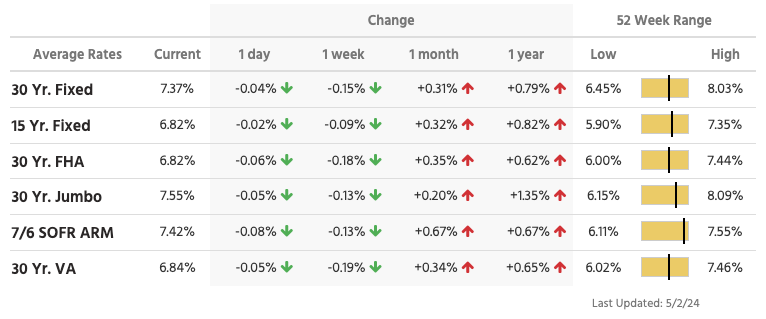

Increasing interest rates continue to limit mortgage borrowing, as indicated by the Mortgage Bankers Association. Their Market Composite Index, which measures loan application volume, decreased by 2.3% on a seasonally adjusted basis compared to the previous week.

Mike Fratantoni, MBA’s SVP and Chief Economist, commented on the situation, stating, “Inflation remains persistently high, leading markets to anticipate prolonged higher rates, including mortgage rates. This presents a challenge for the housing and mortgage markets, with the 30-year fixed mortgage rate reaching 7.29% last week, the highest level since November 2023. Both purchase and refinance application volumes declined over the week and continue to fall below last year's pace. Notably, the ARM share has reached its highest level for the year at 7.8%. Prospective homebuyers are seeking ways to enhance affordability, and opting for an ARM is one method, given that ARM rates are in the mid-6 percent range for loans with an initial fixed period of 5 years."

Weekly Highlights:

Daily Rate Index

Categories

Recent Posts

GET MORE INFORMATION