Weekly Real Estate Monitor for Feb. 19-23

The prospects for the spring market appear brighter as January showed an increase in both the pace of existing home sales and the size of unsold inventory. The National Association of Realtors (NAR) reported that existing home sales rose by 3.1% from December to an annual rate of 4.00 million, although still 1.7% lower than January 2023.

Single-family home sales increased by 3.4% to 3.6 million, while condo sales remained flat at 400,000. The median home price for all residential sales climbed by 5.1% with prices for single-family homes and condos also rising.

The National Association of Realtors (NAR) Chief Economist Lawrence Yun mentioned that the increase in listings and homebuyer activity is a positive sign for the overall market with inventory of unsold homes slightly improved to a 3.0-month supply at the current sales rate. Home prices however still continued to rise, marking the seventh consecutive month of annual price gains. The More Homes on the Market Act (H.R. 1321), aims to lower taxes on home sales to stimulate additional inventory in the market. Kevin Sears, the current The National Association of Realtors (NAR) president, highlighted the importance of more listings to facilitate Americans' ability to move.

Existing-Home Sales Rose 3.1% in January

In January, existing-home sales showed growth as reported by the National Association of REALTORS®. Sales accelerated in the Midwest, South, and West regions, while remaining steady in the Northeast. Year-over-year comparisons revealed an increase in sales in the West and a decrease in the Northeast, Midwest, and South.Total existing-home sales, which encompass single-family homes, townhomes, condominiums, and co-ops, rose by 3.1% from December to reach a seasonally adjusted annual rate of 4.00 million in January.

However, compared to January 2023's figure of 4.07 million, there was a 1.7% decline.NAR's Chief Economist Lawrence Yun noted that while current home sales are lower than previous years, January's increase signals a shift in supply and demand dynamics. With slightly higher listings and favorable mortgage rates compared to the previous year, homebuyers are taking advantage of these conditions.

The total housing inventory at the end of January stood at 1.01 million units, marking a 2.0% increase from December and a 3.1% rise from a year ago. Unsold inventory represents a 3.0-month supply at the current sales pace, slightly down from December but up from January 2023. Price hikes were observed across all four U.S. regions and Yun highlighted that the median home price hit a record high for January, with competitive bidding on mid-priced homes leading to quick sales. The prevalence of cash deals at 32% indicates a market characterized by multiple offers and driven by historically high housing wealth levels.

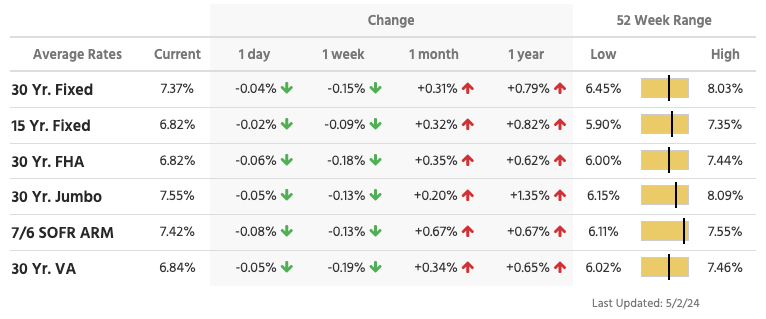

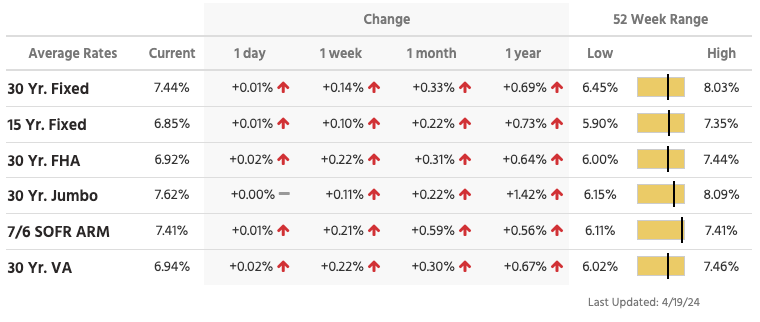

Decrease in Mortgage Applications as Rates Exceed 7% Again

Last week, interest rates headed north of 7% for the first time since November 2023 and continued to dampen mortgage applications and this week was no different. Rates started the week at 7.14% and at 7.10% as of today, a slight improvement from the beginning of the week.

The Mortgage Bankers Association (MBA) reported a 10.6% decrease in its Market Composite Index, measuring application volume, for the week ending February 16. Before adjustment, the volume saw an 8.0% decline with the Refinance Index droping by 11.0% compared to the previous week but showed a slight 0.1% increase from a year ago.

The Mortgage Bankers Association (MBA) SVP and Chief Economist, Mike Fratantoni, noted that mortgage rates rose above 7% last week due to increased inflation in January, reducing expectations of an imminent rate cut. This led to a significant decline in mortgage applications, particularly in refinancing. The impact of these rate changes on potential homebuyers is notable, as higher rates and home values are affecting affordability in a market constrained by limited supply.

Weekly Highlights:

Accelerating Pace of Contract Timelines.

The median time to contract for the week ending February 18 decreased by two days compared to the previous week, standing at 18 days, and was three days quicker than the same week last year. It is anticipated that the time to contract will continue to decrease in the upcoming weeks as more buyers initiate their search with the onset of the spring buying season.

Median List Price Increases.

The median list price sees a 5.1% surge from last week and is a nearly equal jump from last year at this time by 5.2%. Buyers may not be encouraged by the higher list prices; however, good news continues as the number of new listings has surpassed last year for three weeks in a row now.

Showings continue stagnation this winter.

Showings have been gradually decreasing this winter, reaching a total of 81,685 showings. This marks a 14.6% decline compared to the same period last year, with a slight 0.3% decrease from the previous week.

Categories

Recent Posts

Mid-Century Modern in New Jersey: A Timeless Architectural Movement

Weekly Real Estate Monitor for April 29 - May 3

Weekly Real Estate Monitor for April 22-26

Weekly Real Estate Monitor for April 15-19

Weekly Real Estate Monitor for April 8-12

Weekly Real Estate Monitor for April 1-5

Weekly Real Estate Monitor for Mar. 25-29

Weekly Real Estate Monitor for Mar. 18-22

The anticipated outcomes of the 2024 NAR Commission Settlement

Weekly Real Estate Monitor for Mar. 11-15

GET MORE INFORMATION