Weekly Real Estate Monitor for Jan. 15-19

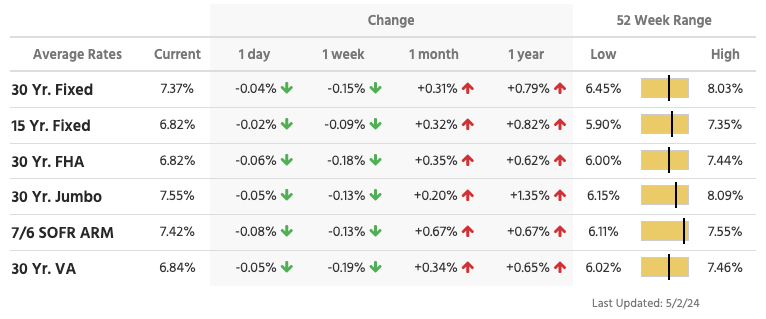

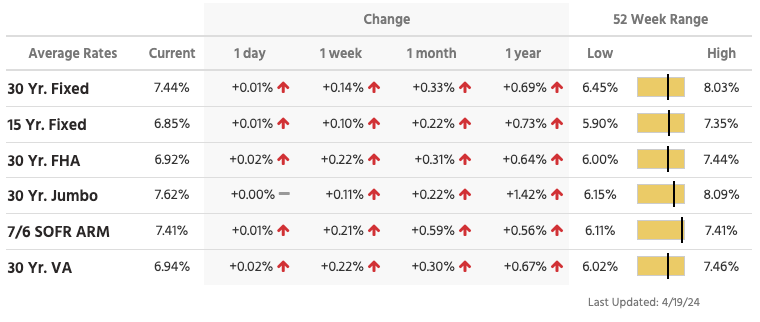

Home buyers can celebrate the sustained decline in mortgage interest rates over the last few weeks of the new year, with rates fluctuating slightly but ultimately staying below 7%. This week with the observance of MLK day, rates started the week at 6.77% and 6.89% as of yesterday, with the historical average for mortgage interest rates since 1971 being 7.74%.

For prospective home buyers, the winter season is an opportune time to establish financial goals for the upcoming year. If a home purchase is on the financial horizon, now is the ideal moment to focus on financial cleanup and engage with a financial planner, mortgage broker, and real estate agent to get your options on the table and learn about the process.

Permits and Positive Builder Sentiment Elevate Housing Expectations for Spring

Housing aspirations for spring received a boost from permits and positive sentiment within the homebuilding sector, despite December's housing starts failing to maintain the growth seen in November. The U.S. Census Bureau and the Department of Housing and Urban Development reported that housing starts in the U.S. were at a seasonally adjusted annual rate of 1.460 million units in December, reflecting a 4.3% decrease for the month. While November starts were revised down from a 1.560 million rate to 1.525 million, the month still boasted the highest figures of the year. December starts surpassed the prior year's pace by 7.5% and exceeded the analysts' forecast of 1.425 million.

In the breakdown, single-family starts registered an annual rate of 1.027 million units, experiencing an 8.6% month-over-month decline. On the other hand, multifamily starts saw a 7.5% increase, reaching a 417,000 annual pace. Single-family starts were notably 15.8% higher than the previous December, while multifamily starts witnessed a 9.5% decrease. The overall permit activity and positive reports from the National Association of Home Builders (NAHB) indicate the potential for a resurgence in construction during the upcoming spring season.

Increase in Mortgage Application Volume Continues Following Rate Drop

The surge in mortgage application activity persisted following the holidays, as reported for the week ending January 12. According to the Mortgage Bankers Association (MBA), the Market Composite Index, a gauge of mortgage loan application volume, experienced a 10.4% increase on a seasonally adjusted basis compared to the previous week. In the initial week of the year, the index had shown a 10% gain, adjusting for the New Year holiday. On an unadjusted basis, the index witnessed a substantial 26.0% rise.

Joel Kan, MBA's Vice President and Deputy Chief Economist, attributed these trends to a decline in mortgage rates across all loan types. The 30-year fixed rate, in particular, saw a six basis points decrease, marking the lowest rate in three weeks. Kan expressed cautious optimism, stating that if rates continue to ease, there is a potential for increased home purchases and prices in the coming months.

Weekly Highlights:

New listings have slightly surpassed the figures from the previous year.

In the week ending January 14, 2024, new listings increased 1.3% compared to the corresponding week a year ago. Despite this rise in listings, the inventory remains limited, presenting a challenge for potential buyers even as interest rates ease.

List prices have experienced a notable surge compared to last year.

The median list price for this week reached a significant 5.7% uptick from the previous year. Sellers have consistently taken advantage of the low overall market supply, enabling them to ask for higher asking prices.

January has witnessed a rise in showings, potentially signaling a robust first quarter.

Although showing activity is slightly lower than the previous year, there has been a steady increase in showings during the initial two weeks of January. This trend could be indicative of a strong start to the first quarter.

Categories

Recent Posts

GET MORE INFORMATION